The financial terms of an exploitation contract for deep sea mining dominated Friday’s discussions. Although technical in nature, these terms are central in the development of the Mining Code, with delegates striving to ensure, among many other issues, a level-playing field for deep sea mining vis-à-vis land-based activities.

In the morning, the Open-ended Working Group on the financial terms of a contract engaged in a dialogue on Thursday’s presentation of an updated financial model for deep sea mining, delivered by Richard Roth, Massachusetts Institute of Technology (MIT). Participants discussed a number of issues, including:

- the need for an equalization measure;

- profit sharing regarding direct and indirect transfer of rights;

- environmental externalities and ways to internalize such costs linked with underlying uncertainties;

- fair distribution of revenues;

- potential differences regarding price volatility associated with deep sea mining vis-à-vis land-based mining;

- difficulties associated with the calculation of the commercial value of nodules based on metallurgical processes;

- reaching the necessary balance between the financial terms applicable to land-based mining as compared to deep sea mining;

- whether minerals from the deep sea are required or not for the energy transition;

- ways to account for intrinsic, social, and cultural values in addition to financial considerations; and

- whether the potential generated revenue will suffice to meet obligations related to the UN Convention on the Law of the Sea (UNCLOS).

Delegates then began consideration of the draft text for the payment system, including revised draft regulations on exploitation of mineral resources in the Area (ISBA/28/C/OEWG/CRP.2), including:

- Equality of treatment (regulation 62), regarding applying the provisions in a uniform and non-discriminatory manner, and ensuring equality of financial treatment for contractors;

- Incentives (regulation 63), including whether the International Seabed Authority (ISA) should provide incentives, including financial ones, to contractors as well as regarding the nature of such incentives;

- Obligation by the contractor to pay royalty (regulation 64), including the consideration of an additional royalty and when the royalty would be paid;

- Payment of royalty shown by royalty return (regulation 70), including whether the Council may approve the payment of any royalty due by way of installment where special circumstances exist;

- Information to be submitted (regulation 71), including whether both wet and dry mineral weights should be reported; and

- Overpayment of royalty (regulation 73), allowing the contractor to request a refund in cases where a royalty return shows any overpayment of royalties.

Participants also discussed the section on records, inspection, and audit. They agreed to report on individual minerals in regulation 74 on proper books and records to be kept. On regulation 75 (audit and inspection) by the Authority, delegates agreed to include that the sub-contractors may also be audited, and that the Contractor should undertake the cost of the audit.

Other regulations discussed included:

- The section on anti-avoidance measures regarding the arm’s-length adjustments (regulation 78);

- Monetary penalties and suspension or termination of an exploitation contract (regulation 80);

- Review of system of payments (regulation 81);

- Review of rates of payments (regulation 82); and

- Payments to the Authority, regarding recording in the Seabed Mining Register (regulation 83).

Under the part on rights and obligations of contractors, regarding the transfer of rights and obligations under an exploitation contract (regulation 23), a regional group noted that if a profit share is envisaged on the transfer of rights, the text of the regulation will need to be amended. On a provision noting that the contractor may transfer its rights and obligations with the prior consent of the Council and with notification to the sponsoring state, some stressed that the sponsoring state needs to give consent rather just be notified.

On the commencement of production (regulation 27), an observer stressed the need for objective criteria regarding when commercial production is reached, and for independent verification of the production levels.

On annual reports (regulation 38), some delegates suggested replacing references to the quality of resources with “dry metal content” and also replace reference to volume of minerals with “tonnage.” On books, records, and samples (regulation 39), a delegate noted that relevant guidelines on the sampling and storage of biological samples will need to be developed.

Facilitator Olav Myklebust (Norway) invited written submissions on all the regulations until 15 May 2023 for further consideration during the second part of the Council’s 28th session to be held in July 2023. Regarding two larger conceptual issues, delegates agreed to intersessional work. An informal group led by South Africa and Australia will focus on an equalization measure to compensate, via an additional royalty, for cases where a contractor does not pay adequate domestic tax. A second group facilitated by Canada and the Intergovernmental Forum on Mining, Minerals, Metals and Sustainable Development (IGF) will address the issue of transfer of rights related to contracts.

Text written and edited by Asterios Tsioumanis, Ph.D., María Ovalle, and Pam Chasek, Ph.D.

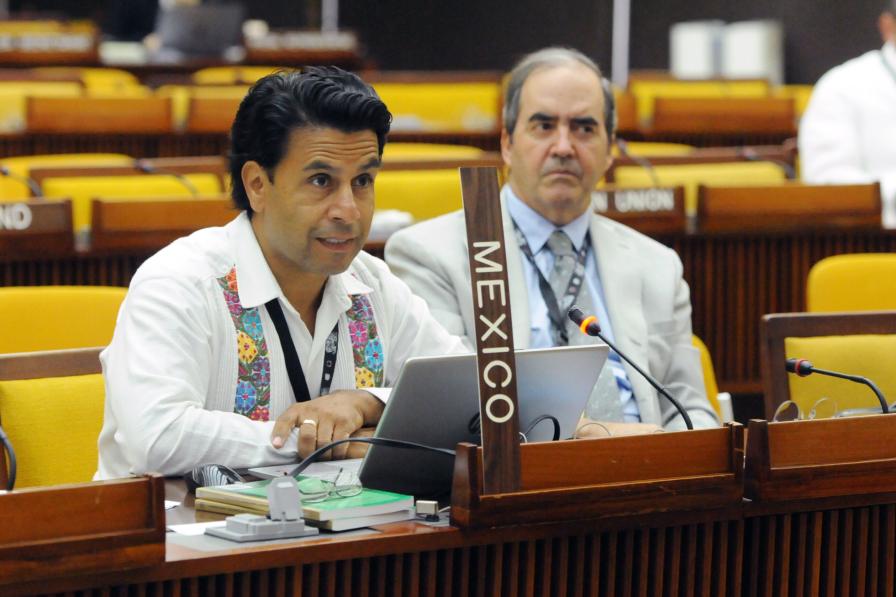

All ENB photos are free to use with attribution. For the 1st Part of the 28th Annual Session of the ISA, please use: Photo by IISD/ENB | Diego Noguera

To receive free coverage of global environmental events delivered to your inbox, subscribe to the ENB Update newsletter.

Informal Council Meeting

(L-R) Mariana Durney, ISA Secretariat, with Lisa Koch and Joe Feldman, Norton Rose Fulbright, Australia

Solomon “Uncle Sol” Kaho‘ohalahala, Maunalei Ahupua‘a/Maui Nui Makai Network, in informal discussions with delegates from the US

(L-R) Thembile Joyini, South Africa; Pradeep Singh, International Union for Conservation of Nature (IUCN); and Elza Moreira Marcelino de Castro, Brazil