Multiple sessions during the morning and afternoon provided stimulating reflections by panelists and participants on the first day of the Global Conference on the Future of Resource Taxation.

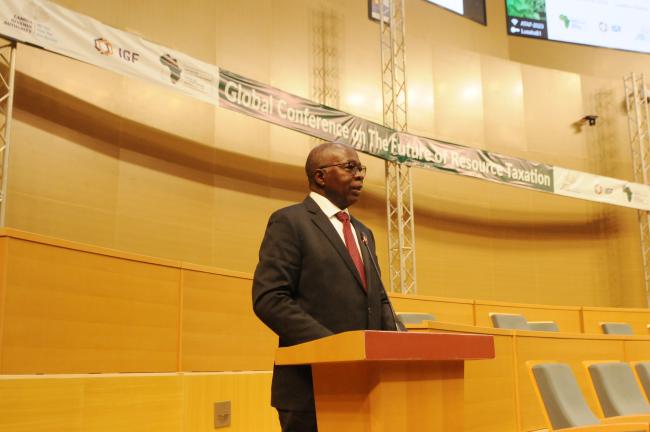

In opening remarks, Situmbeko Musokotwane, Minister of Finance and National Planning, Zambia, stressed the need to strike a delicate balance between attracting investments and creating a fair and equitable taxation framework. Tracing Zambia’s 100+ year mining journey, he highlighted greatly fluctuating commodity prices, aggressive tax avoidance strategies, complex fiscal regimes, and limited capacity as key challenges in increasing the mining revenue base. He described the forthcoming launch of the joint Intergovernmental Forum on Mining, Minerals, Metals and Sustainable Development (IGF) — African Tax Administration Forum (ATAF) Handbook on the future of resource taxation as a “step in the right direction.”

During the first substantive session on the status of domestic resource mobilization, Julien Gourdon, Senior Economist, Africa Department, Agence française de développement, outlined the biggest challenges following privatization efforts over the past decades. In addition to limited administrative capacity, he noted the lack of proper production frameworks in concession schemes and the vicious cycle of undervalued mineral resources that discourage investors and reduce the resource tax base.

Further interventions from panelists addressed the need to:

- ensure transparency and policy coherence as a framework for managing historical as well as future mining contracts;

- balance fiscal support for the artisanal and small-scale mining sector with the need for compliance;

- promote transparency in negotiating baselines for tax regimes; and

- bridge the skills mismatch between investors and government negotiators.

In a keynote address during the second session on financial benefit sharing during a just energy transition to greener solutions, Founding Director of Econias, Iain Steel, identified four steps for governments to maximize associated benefits that span: the implementation of modern fiscal regimes; increasing investment in attractiveness; improving geological understanding; and developing an enabling environment that focuses on ESG and ensure greener ways of mining.

Other issues highlighted in the discussions included:

- challenges in defining and monitoring tax compliance;

- the need to improve collaboration across all finance-related sectors and institutions to ensure policy coherence;

- recognizing the need to invest in creating a specialized and fair tax regime; and

- understanding where value addition in the extractives sector yields substantial benefits, notably in infrastructure and social investments targeted at local communities.

The afternoon saw animated technical discussions of joint work by the Organisation for Economic Co-operation and Development (OECD) and IGF to develop a ‘Two-Pillar Solution to Address the Tax Challenges Arising from the Digitalisation of the Economy,’ a statement which was included in the OECD/G20 Inclusive Framework on Base Erosion and Profit Shifting and by early June 2023 has been agreed by 139 member jurisdictions.

A final session considering ways of accelerating a low-carbon transition through taxation tackled difficult questions, including implications of the forthcoming EU carbon border adjustment mechanism on the mining sector.

In the evening participants attended a welcome cocktail reception, hosted by the Zambian Revenue Authority.

The meeting is taking place at the Mulungushi International Conference Centre in Lusaka, Zambia.

To receive free coverage of global environmental events delivered to your inbox, subscribe to the ENB Update newsletter.

All ENB photos are free to use with attribution. For the Global Conference on the Future of Resource Taxation, please use: Photo by IISD/ENB | Diego Noguera